Every business involves the risk factor. It may come from sudden accidents, natural calamities, or lack of sincerity. Similarly, cleaning businesses have risks that can come from damage to client property or getting hurt by harsh chemicals.

In these cases, cleaning business insurance could be a solution to adjust unexpected costs. If you have a cleaning business, you probably look for insurance, such as workers’ compensation and general liability insurance.

Last year one of my workers damaged a client’s property. But insurance for cleaning companies helps me to adjust damage.

Are you interested in knowing the process of “How to get insured for a cleaning business?” If yes, then you are in the right direction. In this article, I will briefly discuss cleaning business insurance.

More About: Who Has The Cheapest E&O Insurance?

What is covered by insurance for a cleaning business?

In case of unexpected claims for property damage or natural disasters, cleaning business insurance protects your company and assets. Cleaning business insurance cover many things, such as:

- Workers who become ill or injured on the job.

- Client property that is accidentally broken or damaged by employees.

- Traffic collisions involving company vehicles.

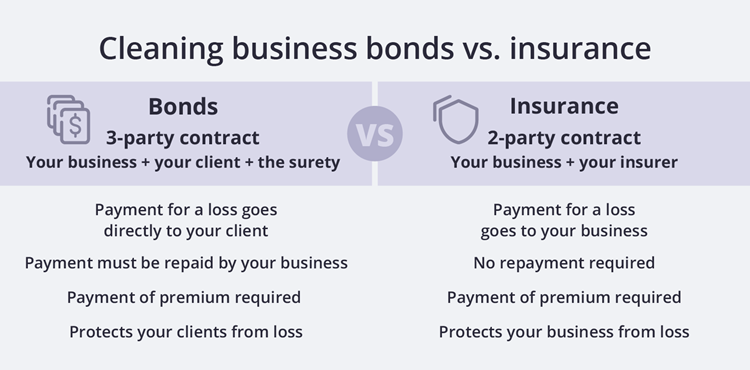

Importance of bond to operate a cleaning service

If you have a cleaning services business, consider purchasing a fidelity bond. It is also known as an employee dishonesty bond. These bonds protect your customers if an employee steals property while servicing a client’s home.

For many cleaning companies, a bond for janitorial services makes sense. Up to the maximum amount purchased, this fidelity bond pays your client directly in case of theft or property loss. It also prevents you from paying customers out of pocket for losses.

Process of being insured for your cleaning business

There are multiple steps involved in “How to get insured for a cleaning business.” Your requirements will determine the perfect insurance provider for your cleaning business.

Contact an online business insurance provider

You have to consider an online business insurance provider for quick coverage. However, if you need more robust coverage, like fidelity bonds, you may need to work with a local business insurance agent.

Because they all calculate premiums differently, each company will probably provide you with a slightly different business insurance quote.

Know Government policy

You have to find out what your local government, county, or state might need regarding insurance or bonds for your cleaning business. To begin, get in touch with the chamber of commerce in your area to learn about the legal requirements there. After that, you have to manage a janitorial business license.

Determine your insurance budget

Budget is crucial in every step of business. You might need more money for insurance. Thus, it is vital to determine how much coverage your company can afford and weigh the costs against its risks.

You might be tempted to save only the bare needs for insurance protection, but doing so could ultimately be bad for your company.

Assess the most significant risks you face in the cleaning industry.

The following are some of the most usual threats that cleaning businesses face.

Damage to third-party property: Imagine that your employee is dusting a shelf in a client’s home. And they accidentally knock over a costly vase. The client could sue your business for the damage. Liability insurance covers your legal costs.

Damage to clients: A client can sue if you hurt him with your actions. For instance, your company may be liable if a homeowner trips over a vacuum cord, injuring their ankle. Fortunately, a general liability policy insurance helps you to cover the medical costs.

Accidents or illnesses among employees: Window cleaning and other janitorial services can put employees at risk for serious harm. Workers’ compensation insurance will cover the costs if an employee gets hurt when they fall off a ladder.

Accidents in commercial vehicles: Let’s say you have a pool cleaning company, and your workers use company vans to get to work. You must consider hiring non-owned auto insurance if your workers use their cars for business travel. Commercial auto insurance would pay for injuries or damage to the car or other property in an accident.

Dishonest employees: Dishonest employees are unfortunately common. Janitorial bonds will directly compensate the customer for their loss if one of your employees is found stealing from them. Get insurance for your cleaning business to protect it.

Cost-determining factors for cleaning business insurance.

Several factors influence the cost of insurance for your cleaning business. Those include:

- The location of your company.

- The risks it faces.

- The size of your company.

- The number of workers.

- Deductibles.

- Coverage limits.

The cost can vary depending on the coverage if you buy more than one insurance for business protection.

Approximate cost for cleaning business insurance

The costs for insurance and bonds for cleaning companies vary depending on their size and work.

- Insurance Type Annual Premium Cost Coverage Amount.

- General Liability $500 to $4,500 $1 million occurrence limit.

- $2 million total limit.

- Commercial Property $400 to $1,500 $5,000 to $10,000.

- Commercial Auto $1,900 to $4,400 $500,000 mixed single liability limit.

- Workers’ Compensation is $5,000 to $6,800 $100,000 bodily injury (per accident).

- $500,000 bodily injury policy limit.

- $100,000 bodily injury disease (per employee).

- Business Owner’s Policy (BOP) $2,300 to $5,100 $1 million occurrence limit.

- $2 million aggregate limit.

- $15,000 in the property.

Different types of cleaning insurance

You can consider cleaning insurance for your business. It will help you in your worst time. Also, it can increase customer satisfaction that your business is real. It would be best if you considered the following insurance for your business.

Insurance for general liability

Liability insurance will protect your business from standard risks, like third-party injury and property damage. Liability insurance coverage is often required in lease agreements and client contracts. On average, a cleaning company’s general liability insurance costs less than $45 per month or $530 annually.

Yet, remember that businesses with a higher risk generally charge more. For instance, the average cost you have to pay for general liability is $693 if you have a large pool cleaning business. Also, a small house cleaning business costs $504 per year.

Commercial auto insurance

In nearly every state, a business car, such as a pool cleaning van or septic tank truck, is required by law. In case of an accident, this insurance covers medical expenses, property damage, and legal fees. Your staff members may reduce to work in their vehicles. If so, you should consider auto insurance for hired and non-owned vehicles.

Also, it covers leased and rental cars. For cleaning firms, commercial car insurance costs around $130 per month or $1,555 per year. The cost of non-owned and hired auto insurance policies is comparable. Most cleaning companies receive a $1 million commercial motor insurance coverage.

Workers’ compensation insurance

This insurance covers worker medical costs and missed income in the case of an accident or sickness at work. Nearly all states require it for employees-only cleaning businesses. On average, a janitorial services company’s workers’ compensation insurance costs less than $150 per month or $1,785 annually.

But, when determining your premium, insurers consider your occupational risk and the number of employees you have. The requirements for workers’ compensation coverage vary by state. Before purchasing a policy, ensure you are familiar with your state’s requirements for workers’ compensation.

Commercial umbrella insurance

Your commercial umbrella insurance will begin to offer extra coverage whenever the underlying approach’s cap is reached. This policy may be necessary for your small business to comply with some client contracts.

For a cleaning company, the average annual cost of a commercial umbrella insurance policy is $758, or about $63 per month. The amount of coverage you purchase determines the rate you will pay. The most common price for commercial umbrella insurance is one million dollars.

Additional inquiries by insurers

Insurers will take the following elements into account when evaluating your business:

- Histories of claims: Your premium will be impacted if you have filed a claim in the last three to five years.

- Employees: How many people are employed by you? Both the liability and the workers’ compensation will be affected by the response.

- Location: Where are you employed? Do you clean out of state, and how many miles do you drive?

- Limits: Typically, the premium is higher than the limit.

- Work type: Are you a cleaner for homes or businesses? Does your job involve removing water and mold?

- Risks for businesses: Do you clean schools, hospitals, or companies open 24/7? When cleaning, what precautions do you take to reduce risk?

- Hazardous materials: Chemicals are usually used in cleaning. What are you doing with any chemicals or hazardous waste?

When applying for insurance for your cleaning business, you should be ready to answer questions like these and others. It can be tempting to frame your responses to reduce the premium, but it is essential, to be honest.

Frequently asked questions

To start a cleaning business, you probably have to know “How to get insured for a cleaning business.” In this section, I have included some questions to help you mitigate confusion about insurance for a cleaning business.

Do I require liability insurance for my cleaning business?

Most of the time, all businesses need workers’ compensation insurance. Yet, it would be best if you inquired about your state’s specific requirements. You may also be required to carry insurance from some vendors or your lender if you have a business loan. Thus, it is up to you whether you will get liability insurance or not.

What is covered by insurance for cleaning liability?

Insurance for cleaning liability covers reputational damage, property damage, and bodily harm. The insurance company will investigate whether your company is legally responsible for the injury, damage, or allegations of reputational harm if a claim is filed. Your carrier will attempt to handle the claim within the limits of your policy if it is determined to be liable.

How much does insurance for a cleaning company cost?

Many factors determine the premium. From $500 to $4,500, a liability policy can cost. A commercial auto policy can range from $1,900 to $4,400, while a commercial property policy can range from $400 to $1,500.

When insurance companies consider covering my company, what are their main concerns?

The majority of insurance companies want accurate information about your business’s activities. The insurance company may want to know the age of your company, the number of employees, and your industry experience. They may also ask for your expertise in the business.

Are there any effects on my insurance premiums from the chemicals or equipment I use?

Your inland marine (or Tools & Equipment) policy’s price will only be affected by the equipment you use.

How can I obtain policy discounts or deductions?

If you want to obtain discounts, you must buy your BOP (or GL) policy from the same company that also offers workers’ compensation coverage. For additional savings, you can also include commercial auto insurance.

What is the estimated cost of Commercial Auto insurance?

The estimated cost of commercial auto insurance is $1,900 to $4,400.

What is the estimated cost of Workers’ Compensation insurance?

The estimated cost of commercial auto insurance is $5,000 to $6,800.

Final Thoughts

You might be just starting as the owner and operator of a residential cleaning service or running a large, well-established industrial cleaning company. In that case, you should still think about getting cleaning insurance.

After reading the article “How to get insured for cleaning business,” you get a precise idea about how to protect your company and assets through insurance assistance.

With a broker, it is easier to find the right coverage because there are so many options. But you will get an initial idea about the cleaning insurance business from this article. Isn’t it?

Mehedi Hasan is an insurance expert with over 6 years of experience in the industry. He has a deep understanding of various types of insurance policies and is skilled at helping clients find the coverage that best fits their needs. In his current role, Mehedi works as a consultant, advising businesses and individuals on the best insurance options for their specific situations.

He is also a frequent speaker at industry events, sharing his knowledge and expertise with colleagues and professionals in the field. Mehedi holds a degree in insurance and risk management and is committed to staying up-to-date on the latest industry trends and developments. In his free time, he enjoys reading, traveling, and spending time with his family.