AAA is one of the best insurance companies in America, with a wide range of services, coverage options, and discounts. Now you may wonder what AAA has to offer.

AAA offers a wide range of auto, home, rental, life, and small business insurance. The insurance company has served customers for over a century and can help you save money on almost anything. You can manage your policy online from your smartphone, desktop, or tablet whenever and wherever you want.

My journey with AAA auto insurance became more manageable because I could access my policy online. It assists me in not carrying my insurance card everywhere.

Are you curious about aaa insurance and how to print aaa insurance card online? Do not worry. I will assist you in mitigating your curiosity to know details about it.

Let’s take a close look at how it performs in a handful of key areas, including its managing processes online.

AAA insurance and the process of printing aaa insurance Cards online

AAA insurance is a collection of products, services, and programs under the AAA brand that are available to qualified AAA members. AAA offers different types of insurance, such as automobiles, houses, and life. Customers can get many discounts based on the insurance package.

Customers signed in to “My Account” can download PDF versions of printed insurance cards. You must first add your insurance policy to your online account to enable self-service options, such as viewing electronic proof of insurance cards.

There will be a link to “View Proof of Insurance” (PDFs) for that policy after you have added it online. If you are already signed in, you can access “My Account” by clicking “Sign In” or “My Account” in the top right corner. In this way, you can complete the process of how to print aaa insurance card online.

How to access self-service options “My Account.”

AAA insurance customers can access the self-service option “My Account” in three ways:

- Customers must visit AAA.com through their desktop to enjoy self-service options for My Account.

- Customers can access My Account by visiting AAA.com through their mobile phones.

- Customers can enjoy the self-service options for My Account by using AAA Mobile App.

Advantages of using MyAccount

If you use AAA MyAccount online service, you can enjoy several facilities. Those are:

- Proof of insurance ID cards can be printed or viewed.

- You can set preferences for going paperless anywhere and enjoy the AAA insurance service.

- There is an opportunity to set up automatic payments.

- If you want, you can add or remove drivers and vehicles. However, this opportunity is not available for all policies.

- Suppose you need insurance policy documents urgently, then you can access important insurance policy documents using my account.

More About Insurance Policy: aninsurancepolicy.com

How to purchase AAA insurance?

If you want to purchase AAA insurance, you have to follow some steps. First of all, you have to get an AAA membership card. Then you can choose a different type of insurance policy from AAA. Once you decide which insurance policy you want to buy, then, you can purchase your desired AAA insurance by using the membership number.

How to become a AAA Member?

You can join AAA by providing some necessary information. This process can be done in two ways. You can join AAA online or complete the process at a regional office. The next step is to select one of the company’s available plans.

Join AAA online

Visit the website of the American Automobile Association (AAA)

Visit http://www.aaa.com to begin. The AAA is a federation of clubs serving various regions. On the other hand, you can visit this website to get to any of these clubs.

Enter your zip code

The AAA website may automatically determine your general area and direct you to the appropriate page for that area. If it does not, a pop-up box will probably appear and ask you to enter your zip code.

Click Join AAA

Numerous regional websites are laid out in a variety of ways. However, the homepage should have a Join Now or Join AAA button or text link. To apply online, select the Join button or link.

Compare the plans

You will see a chart comparing the advantages of various membership plans when you click Join. The specifics of these vary from regional organization to regional organization. Still, the advantages are typically presented clearly in a chart.

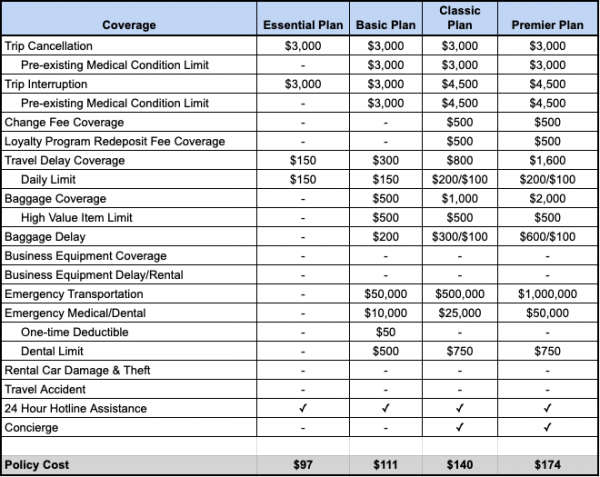

The organization provides Classic (or Basic), Plus, and Premier membership plans. The Plus and Premier memberships are more expensive. Still, they come with additional benefits like free towing or, under certain conditions, free travel insurance. If you want additional information, click the “View details” link.

Be aware of the price

The annual cost of the Membership is shown in the “Primary Member” price. When you join, you typically pay an additional “Enrollment” or “New Member” fee. It is a one-time fee.

Last but not least, if you want to give the same benefits to another member of your family, you may have to pay an additional “Associate Member” fee each year for each additional member.

Submit contact details

When you click on the “Join” option for a particular plan, you should be taken to a form. Follow the prompts to enter your full name, personal information, and contact information. Hit next when you are finished.

Decide whether automatic membership renewal should be enabled

You might be asked to provide additional information, like associate member details. Find the option labeled “Convenience Billing.” If you do not want your credit card to be billed annually at the end, select “No.”

If you want your Membership to be renewed annually automatically, keep it selected as “Yes.” If you disable convenience billing, you will need to pay your annual dues manually to keep your membership benefits.

Provide the details of your payment

Enter the information for your checking account or credit card. Your membership card should arrive in the mail within a few days after you confirm the order via email.

Avoid entering your credit card information on a public, unsecured internet network.

Apply in person for AAA Membership

You need to visit the AAA office in your area if you want to apply for a membership in person. It may take time, and you must go from one desk to another to complete the requirements. If you have difficulty finding a nearby branch of AAA, you can call this number- 866-222-6595.

The advantages of AAA Membership

AAA members can enjoy many benefits. Some are available to members of all three tiers, while others are only available to Plus or Premium members.

1. Classic Membership:

Depending on the regional club, the AAA’s introductory membership tier is either Classic or Basic. Although each club’s Classic services and benefits are different.

- Emergency Roadside Assistance

Roadside assistance is the most prominent benefit of AAA. Classic members receive at least four free roadside assistance calls each year. The member is responsible for paying for calls beyond the four-per-year limit, typically costing $50 or more.

Responders offer various services during roadside assistance calls, free battery testing, jump-starts, and flat tire replacement. AAA members can transfer their roadside assistance services to other vehicles. For instance, if you are in a friend’s car and it breaks down, you can use your AAA benefit without incurring any costs.

- Insurance for Travel

Classic members receive two fundamental travel insurance policies of aaa: trip accident coverage (typically $100,000 per party) and trip interruption coverage (up to $500 per party). Club-specific coverage limits may differ.

2. Plus Membership

All of the benefits of a Classic membership are available to Plus members and the following. Some are expanded versions of Classic benefits. Others are brand-new benefits that you gain access to.

Plus insurance members get three basic travel insurance policies with higher limits that may vary depending on the club. Family coverage for Plus typically ranges from $500 to $1,000. Lost baggage coverage is limited to $250 per party. Travel accident coverage is unlimited to $200,000 per party.

3. Premium Membership:

In addition to the benefits mentioned above, Premier members receive all Plus membership benefits. Some are exclusive to Premier, while others are enhanced versions of benefits offered at lower tiers.

- Booking a Rental Car for Free:

When a Premier member’s vehicle breaks down, they are entitled to one free day on their Hertz rental and complimentary reservation assistance from AAA agents. There is a 20% to 25% discount on additional rental car days.

- Premier Insurance for Travel:

Travel insurance coverage is slightly more generous for Premier members than for Basic members. Trip interruption coverage typically exceeds $1,000 per person. Travel accident coverage typically exceeds $200,000 per person.

- Discounts at the Premier Travel Store:

AAA Travel Store members receive larger discounts, typically 20% off. In addition to the identity theft protection benefits offered to Classic members, Premier members receive insurance from Experian for up to $10,000.

Frequently asked questions

I have tried to answer some common questions about “how to print aaa insurance card online” in this section.

Where do I go online to print my AAA insurance card?

You can print a free copy of your Digital Membership ID card from the website of AAA. First, you have to visit AAA.com. After that, you have to sign in to your account to download an insurance card.

Can a Proof of Insurance Card be printed online?

Yes. Customers signed in to “My Account” can download PDF versions of printed insurance certificates of AAA.

How do I set up my account for payments automatically?

By logging into your account on aaalife.com or the AAA Mobile app, you can set up Autopay.

How do I pay for my insurance policy online?

Online premium payments are simple with AAA. Click “Pay now” after logging in to your account at aaalife.com or the AAA Mobile app. With EFT, you can pay AAA with a credit card or from your bank account.

When you set up Autopay, you will never have to worry about missing a payment. Alternatively, you can visit Quickpay and make a one-time payment.

Will I be informed when my payment has been processed?

Yes. When you make a payment online or register for an account, AAA will send you an email confirming the payment. Check your SPAM folder if the email has not been delivered to you.

If you make a phone payment through the self-service system or with a Member Services Advocate, you will receive a confirmation code.

Is my data safe with aaa insurance?

AAA insurance uses the information you provide to manage your policy. They will adhere to the guidelines outlined in their privacy policy regarding using and protecting your information.

Because their brand and reputation are important to them. Please read their terms and conditions and privacy policy for more information on these guidelines.

How do I get out of my Membership?

Visit a branch and ask for assistance from a specialist to cancel your Membership. The hours of operation of each branch are different.

You can also call membership services at 1-877-374-5116, Monday through Friday, from 8:30 a.m. to 5 p.m. The dues you paid will be refunded proportionally, minus any new member admission fees or discounts.

How do I obtain a copy of my certificate or policy?

A policy owner can request a duplicate certificate or policy by calling (800) 684-4222.

Final Thoughts:

AAA provides complete coverage for your automobile, house, life, and other assets. It allows you to save money while receiving the insurance you require and renowned service. You can manage your policy through mobile apps as a AAA insurance customer.

By managing your policy, you can download or print insurance cards if you have a proper idea about how to print aaa insurance card online.

Mehedi Hasan is an insurance expert with over 6 years of experience in the industry. He has a deep understanding of various types of insurance policies and is skilled at helping clients find the coverage that best fits their needs. In his current role, Mehedi works as a consultant, advising businesses and individuals on the best insurance options for their specific situations.

He is also a frequent speaker at industry events, sharing his knowledge and expertise with colleagues and professionals in the field. Mehedi holds a degree in insurance and risk management and is committed to staying up-to-date on the latest industry trends and developments. In his free time, he enjoys reading, traveling, and spending time with his family.