Ski Safe is an insurance company that can protect your boat, yacht, or personal watercraft from damage almost anywhere on the water, in storage, or on the road at a cheap cost.

A contract between you and your insurer regarding the terms, conditions, coverages, exclusions, and coverage obligations is known as an insurance policy. Knowing your insurance policy’s ins and outs can be very helpful.

Last year, Ski Safe insurance helped me cover the cost of repairing equipment damaged by me when I was boating in the sea.

Are you interested to know about Ski Safe? Do not worry! I will assist you in knowing “Is ski safe insurance good.” You must read the whole article to know Ski Safe.

The success story of Ski Safe

Over the past four decades, Ski Safe has only served the boat, jet ski, and personal watercraft (PWC) industry. The Ski Safe team has more than 500,000 insured boaters. They know how to keep you safe from many dangers.

Ski Safe holds a full license; they can write, sell, and service insurance policies and adjust all claims. They provide policies for many boats, including bass outboards, center consoles, inboard motor yachts, pontoons, sailboats, and yachts.

The specialty of Ski Safe

- The adjusters and underwriters on the Ski Safe team are seasoned boating experts. They will be with you every step to make the insurance process more individualized.

- A Ski Safe boat insurance policy provides increased access to a comprehensive selection of choices.

- Ski Safe was designed for the 21st century so that you can do everything online. The internal frameworks and external procedures of Ski Safe insurance are intended to provide the industry’s most user-friendly insurance experience. Your coverage, deductible, and other options can all be reviewed and altered.

Discount opportunity in the Ski Safe Insurance

As a client of the Ski Safe policies, you can grab the opportunity to get a discount. Prices for Ski Safe policies vary based on various factors, such as the craft’s value, age, and location. Your insurance history, past claims, experience, and other factors determine the cost.

- If you take a boat safety course, you will get a discount.

- A clean driving image can give you a discount.

- Also, if you have sufficient boating experience, you will get a discount from the company.

- You may get a discount if you only navigate in protected waters.

How to lower the insurance policy price?

When buying an insurance policy, it is important to consider how much you can pay out of pocket for a claim versus how much you can afford to pay each year for the premium.

You will evaluate your own risk here. Your policy will charge a lower premium if you are willing to pay a higher deductible.

In addition, if you are eligible for a discount, your rate may be reduced. For instance, weather-related damage is less likely if you boat in an area.

Impressive customer service

Ski Safe has impressive customer service. If you want to keep in touch with Ski Safe policy’s team, you can do it through email, phone, or the live chat feature on their website.

- You can contact them by dialing (800) 225-6560.

- If you want to speak to a representative via live chat, you must visit their website.

- You can also contact them through mail: [email protected].

What do Ski Safe boat insurance policies cover?

A Ski Safe boat policy may cover your boat (or personal watercraft) and property in the event of damage caused by fire, theft, weather, and other events. Boat insurance cannot prevent you from being in an accident; it can assist in protecting you from a variety of risks. Here is a list of popular coverage options:

“All Risk” Protection

The phrase “all-risk” refers to insurance covering any risk the policy doesn’t explicitly exclude. It covers fire, theft, collision, and other common risks.

Example: Flood damage to the boat should be covered under an “all-risk” boat insurance policy if it is not explicitly excluded.

Liability for bodily harm and damage to property

If you are responsible for the injuries of others and are involved in an accident, bodily injury liability protects you. Liability for property damage can help you pay to fix or replace other people’s boats or property that you damaged while boating.

Example: You damage property and injure people on a privately owned dock when you crash your boat into it. Up to the policy limit, liability coverage for bodily injury and property damage may assist you in paying for dock damage and injuries-related damages.

Coverage for Health Care Costs:

If someone is hurt in an accident that involves your boat, medical payments coverage may assist in paying for the medical expenses of your guests and other third parties.

Example: A friend accidentally cuts his hand while fishing. Your friend requires stitches but has not yet met his health insurance policy’s deductible. This expense may be covered by your boat insurance policy’s medical payments coverage.

Coverage for pollution, fuel spills, and the environment

A fuel spill can be caused by an accident at a fueling station, a leaking tank, or a sinking boat. Your Ski Safe boat insurance policy may include fuel spill coverage. It may assist you in covering the costs of an accidental fuel spill.

Example: While docked, your jet ski sinks. You may be required to deal with fuel spills by the Coast Guard. If you have coverage for fuel spills, you can contact Ski Safe to file a claim.

Coverage for Uninsured or Underinsured Boaters

Uninsured/underinsured boater coverage may pay for your injuries if you are hit by a boater who does not have insurance.

Example: Suppose you are hit by another uninsured boater, breaking your arm. The boater has no insurance that will assist in paying for your injuries and cannot afford to pay for them out of pocket. Up to the limits of your policy, uninsured boater coverage may cover the boater’s liability.

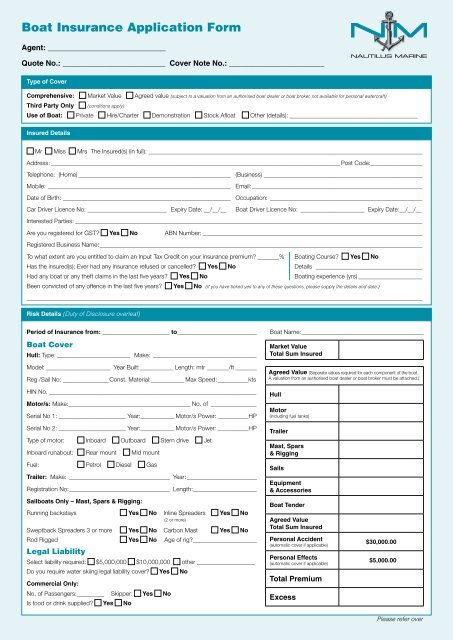

Boat Insurance Application

Ski Safe launches self-service boat insurance application, “Manage My Policy.” Ski Safe customers can immediately view and download policy documentation through this app. Clients can make changes and request additional features online through “Manage My Policy.”

Imagine showing proof of insurance when you move your boat to a new marina. Boaters who use Ski Safe can now get a copy of their policy and a certificate of insurance. It shows the new marina in a matter of seconds, even from their phone.

Ski Safe recognized the boating community’s need for a self-service application and hopes that “Manage My Policy” and its future enhancements will provide boaters across the country with the best docking space.

Advantages of Ski Safe Insurance

Is ski safe insurance good? Yes, it is. It has many advantages.

- Packages of insurance are made to meet the specific needs of each kind of boat in terms of coverage.

- Liability coverage for water sports is included in all policies.

- As long as they are not used during the lay-up period, boats are still eligible for coverage.

- There is useful information about boating and boat insurance coverage on the Ski Safe website.

Disadvantages of Ski Safe insurance

- There are no special discounts available for senior citizens.

- Compared to its rivals, Ski Safe provides relatively fewer options for lowering premium rates.

- The premiums must be paid all at once.

- There is not much information about the policy or the coverage details on the website.

- For older boats and boats larger than 36 feet, boaters may be required to complete a survey.

Frequently asked questions

In this segment, I have included some questions about “Is ski safe insurance good.” I hope it will guide you to reduce your confusion.

What is a Premium for Insurance?

The simplest definition of the term “premium” is the amount an insurance company charges you to purchase a policy. In the end, insurance is a financial investment. Your insurance premium is essentially its cost.

How are insurance premiums calculated?

The insurance company determines the basis for insurance premiums. Then, in addition to the base premium, you will receive discounts based on your personal information, location, and other factors.

Discounts on Ski Safe policies can help you save money overall on your premiums. The premium is paid annually but can also be paid in multiple installments.

What factors determine the amount of the premium?

The amount you pay will be different based on the risk and the kind of coverage you want. The risk will change from person to person. The most important factors that will affect your premium are listed below.

Type of Protection

When you buy a policy, you have several different coverage options. A good rule of thumb is that the more coverage you have, your premium will likely be higher.

Quantity of Protection

As mentioned earlier, when you buy insurance, you will probably have to pay more for coverage. The insurance cost for a $25,000 boat will likely be lower than that of a $100,000 boat. In this case, the amount of coverage is determined by the insured’s value in dollars.

It all comes down to this: the premium is more expensive, and the higher the insured value. If you pay a higher deductible, you might also get the same level of coverage for less money.

Individual Risk Factors

Your risk factors heavily influence the premium you pay. Your boating history, location, level of experience, and other factors will all play a significant role in determining risk.

What is the price of boat insurance?

The cost of boat insurance varies based on the policy’s coverage limits and other elements, including:

Location.

Experience.

Past claims.

Driving record.

The type of watercraft.

Other risk factors.

How does an Insurance Deductible work?

When you buy a policy, you shield yourself and your money from unanticipated dangers in the form of damage or loss. That puzzle includes your deductible. You also agree to pay the first part of a covered loss, or your deductible, while the insurance company agrees to pay for it.

What Is Covered by Boat Insurance?

Diverse coverage is included in boat insurance to assist in various circumstances. The most fundamental type of coverage available for boats is liability insurance. This might assist in covering the cost of any harm your yacht causes to other parties.

Liability insurance will cover part of the costs if, for instance, your boat causes damage to someone else’s property or boat or if it causes injuries to someone during an accident. Other things that boat insurance often covers include the following:

1. Theft, vandalism, and fire-related loss

2. Damage to the boat’s structure and equipment that is permanently attached.

What days is Ski Safe Boat Insurance open?

Ski Safe Boat Insurance opens from Mon-Thu 9:00 am – 7:00 pm. And, on Friday, it opens from 9:00 am – 6:00 pm.

Is Ski Safe insurance authentic?

The Ski Safe insurance is authentic. They have a license to run the business. If you become a member of this insurance, your money will be worth it.

Final Thoughts

Considering the boat insurance coverage of the Ski Safe, you are bound to say that Ski Safe is good insurance. Ski Safe provides potential customers with policy packages designed to meet particular boat types’ specific coverage requirements to simplify the policy selection process.

Clients are generally pleased with premium rates and note that they are cheaper than those offered by other agencies. Policy coverage options and customer service are praised in reviews. Individuals looking for good insurance options will find the package options ideal.

Up until now, you get to know about “Is ski safe insurance good.” I hope it will assist you in considering the best insurance plan. Please let us know in the comment section if you have any inquiries.

Mehedi Hasan is an insurance expert with over 6 years of experience in the industry. He has a deep understanding of various types of insurance policies and is skilled at helping clients find the coverage that best fits their needs. In his current role, Mehedi works as a consultant, advising businesses and individuals on the best insurance options for their specific situations.

He is also a frequent speaker at industry events, sharing his knowledge and expertise with colleagues and professionals in the field. Mehedi holds a degree in insurance and risk management and is committed to staying up-to-date on the latest industry trends and developments. In his free time, he enjoys reading, traveling, and spending time with his family.