Winning customers’ trust is the root of being connected with them for a long time. The customer feels safe when business companies have protected their business through insurance. It indicates that you are not a fraud and are thinking about the customer.

E&O insurance protects your company from the cost of any claims by your customer. You probably want the best services at a lower rate. But, your budget for the insurance has a role in deciding which insurance company’s service you will get. Isn’t it?

Due to covid 19, I had to look for the cheapest e&o insurance to protect my consultant firm. After doing lots of research, I found Hiscox provides lower-cost services.

Do you want to know “Who has the cheapest e&o insurance?” Well, Don’t worry. I will assist in letting you know about the cheapest e&o insurance. With that idea, you can protect your company.

More About: How Do I Get Insurance For My Company?

What is e&o insurance?

Errors and omissions insurance assists your business company by giving advice and services against claims of negligence or other similar claims. It is one kind of liability insurance that protect businesses from covering the total costs of a client’s claim against a consultant, financial advisor, insurance agent, or lawyer.

If a company provides services to customers for a fee, they frequently purchase e&o insurance.

Hiscox: the cheapest e&o insurance

You probably spend a lot of time on google finding the answer, “Who has the cheapest e&o insurance.” The answer to this question is Hiscox insurance. Hiscox is a market leader in small business insurance. It provides a wide range of commercial insurance products. It includes coverage for errors and omissions.

Pros of Hiscox:

- It Covers 180 professions or industries.

- International Coverage.

- Reasonable prices and simple online quoting.

Cons of Hiscox:

- Financially less potent than some of its rivals.

Hiscox often offers liability coverage with $2 million maximum limits. Yet, in some circumstances, more considerable limitations may be permitted. Hiscox is also unique because it pays claims for work done anywhere in the world as long as submitted in the US or Canada. This is a significant benefit for companies that outsource their work.

Affordable rates can be adaptable to the type and size of the business. It is one of Hiscox’s best features. Hiscox’s premiums range from $35 to $65 per month. Some specific firms get a premium of $22.50.

Your firm can save up to 5% on its rates by purchasing multiple Hiscox products. Hiscox also offers reductions to companies that implement sound risk management practices.

Hiscox lets potential customers get quotes online, but they can also call the company for more pricing information.

Hiscox’s claims support process is user-friendly for customers. They can report claims online, over the phone, or in person anytime, day or night. Within three weeks of reporting, Hiscox decides whether claims will be covered.

As part of the E&O insurance, Hiscox can also help connect firms with defense lawyers and risk management experts. The Better Business Bureau has given it an A+ rating. This BBB rating certifies Hiscox’s track record of treating clients fairly.

Although Hiscox’s financial strength is lower than some of its competitors, it consistently receives high ratings from credit rating agencies. It gives reassurance about this strength.

Factors that influence the cost of an E&O policy:

Some factors determine the cost of e&o insurance. Those are:

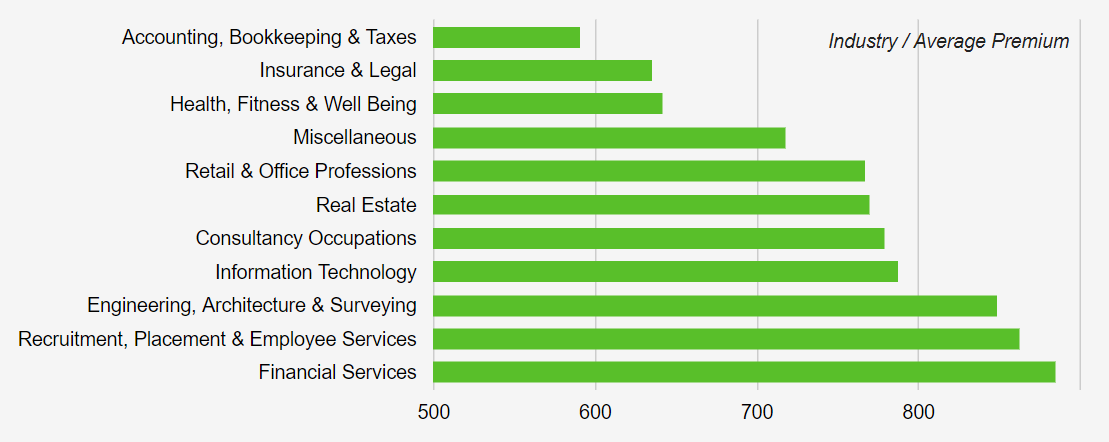

- Industry

The cost of e&o insurance is most influenced by the industry in which a firm operates. Because different industries have distinct risk factors. And insurers will charge more to cover businesses that stand to lose more money in claims.

- Company size

Risk increases as a firm get bigger. When more employees join the team, there is a greater chance that something will go wrong and that the company’s errors will give rise to a liability claim.

- Experience

Established businesses are considered safer to insure due to their excellent expertise and track record. Insurance premiums will therefore be lower for businesses with a more comprehensive history and experience in their sector than those with a shorter history.

- Coverage limits and deductibles

While many factors outside a business’ control affect insurance rates, policyholders can often choose terms of mistakes and oversights that raise or lower their payments.

Deductibles and coverage limits are two examples. Because the insurer runs a more significant danger of going bankrupt with higher coverage limitations. On the other side, deductibles reduce rates because the policyholder holds more of the risk.

- History of Claims

When determining the price of a policy, insurers will look at a company’s past of being sued for damages. In recent years, businesses with a high claim rate are considered riskier to insure because their claim history may frequently reflect inaccurate work. Premiums for businesses tend to be lower when there are fewer claims.

How can I find cheap e&o insurance?

Your small business can reduce costs for errors and omissions insurance by avoiding claims and selecting a higher deductible. Professionals who offer advice or expert services to clients should have errors and omissions in insurance.

It saves your company from client lawsuits alleging that your mistake cost them money. You must ensure that your E&O policy meets any legal or contractual requirements you may have before purchasing it.

Also, it would be best if you did not overpay for a policy that provides more coverage than you require. To obtain suitable e&o coverage at an affordable price, follow these four steps.

- Compare quotes from various insurance providers

The cost of errors and omissions insurance will vary from company to company. Some may even concentrate on serving your sector and providing customized protection at a lower cost.

Yet, only some deals are created equal. It would be best if you struck a balance between cost and coverage to get the most protection for the least amount of money.

For a low-risk business, an expensive e&o insurance policy may not be necessary, while for your business, a cheap policy may not provide sufficient protection. Compare quotes from leading US insurers for errors and omissions insurance.

- Work with an agent who is familiar with your company

Working with an experienced insurance agent can save you money. An insurance agent familiar with the risks associated with your industry is more likely to find you a policy that meets your needs and budget. Choosing lower limits, for instance, can help you cut costs on your insurance.

A knowledgeable agent can assist you in establishing appropriate limits. He can suggest the best insurance that is compatible with your risks and advise you of add-ons that you can safely skip. You might only be able to tell if the policy in front of you offers enough coverage if you get professional assistance.

- Maintain a clean claim history

A claim on your E&O policy can raise your premium, just like with auto insurance. Client disagreements frequently lead to errors and omissions lawsuits. An insurance agency may likewise be hesitant to protect a business with an extensive record of cases, except if that business will pay more.

Fortunately, you can reduce the likelihood of a claim by taking steps. You and your customers can stay on the same page with the help of clear communication, detailed contracts, and other measures.

- Choose higher deductibles

The amount you must donate to a claim to receive insurance benefits is a deductible. Imagine that the total cost of an E&O lawsuit is $50,000, and your deductible is $5,000. After you have paid the $5,000 deductible, the insurance policy will cover $45,000.

When it comes time to select an insurance plan, the deductible ought to play a significant role in your decision-making process.

In general, lower premiums are reflected in higher deductibles. Your business will be required to pay a more significant share upfront in case of a claim. A higher deductible might be worth it if you Are mainly concerned about unlikely but costly claims.

In case of a claim, the amount you pay toward your deductible may be insignificant compared to the amount covered by the insurance policy. On the other hand, the policy might not cover losses if they are less than your deductible.

Frequently Asked Questions

When you buy e&o insurance for your business company, you might look for the answer, “Who has the cheapest e&o insurance.” In this section, I have added a few questions that will enhance your knowledge about e&o insurance.

Does working from home necessitate e&o insurance?

Yes, regardless of where you are, you can be sued for negligent errors and omissions. Thus, it is vital to have e&o insurance as long as you provide a service to a customer.

What distinguishes D&O insurance from E&O insurance?

E&O (Errors & Omissions Insurance) covers any professional who provides a service. On the other hand, D&O (Directors and Officers Insurance) only covers a company’s directors and officers. Both policies cover mistakes and omissions that happen due to carelessness.

What is the distinction between professional liability and errors and omissions (E&O) insurance?

The terms “errors and omissions” and “professional liability” refer to the same insurance policy covering professionals and consultants for errors and omissions in their work. This policy may be necessary to protect your business practice. It is also known as malpractice insurance in some industries.

How much does insurance for errors and omissions cost?

It depends on whether your company’s specific liabilities will be covered by your errors and omissions policy. When calculating your premium, your insurance company will consider your industry, claims history, and services. Your cost will also be impacted by the options you select, such as the type of coverage, policy limit, and deductible.

When should I purchase insurance for errors and omissions?

Errors and omissions insurance should be purchased as soon as you can. As a “claims-made” policy, this insurance only pays claims if the incident and subsequent litigation occur while the policy is activated.

To ensure there are no coverage gaps, most small business owners buy errors and omissions insurance early on. And they stick with the same policy for the duration of their enterprise.

How does insurance for errors and omissions protect my company?

Insurance will pay for your legal fees if you are sued due to the quality of your work, errors, and omissions. Depending on the complexity of the dispute, errors, and omissions insurance can cover the cost between $10,000 and $100,000.

Do independent contractors require insurance that covers errors and omissions?

Independent contractors, like small businesses, can be held accountable for oversights and errors. It can result in customers’ financial losses. They may require this policy to: Conform to state laws, comply with client contracts, and defend against lawsuit costs.

What happens if I cancel my errors and omissions insurance policy?

You could end up paying more for coverage in the future if you cancel your policy. Businesses that initiate and terminate coverage incur higher rates from providers. Additionally, cancelling an E&O policy puts your company at risk. As a result, you might fail to get lots of customers.

Final Thoughts

One of the instincts of human beings is they make mistakes. It can happen at any time in your life.

Error and omission insurance can help you in your hard time. Your consultant team might provide misinformation to the client. Due to that, they face loss. At that time, e&o insurance can cover your cost. Thus, knowing “Who has the cheapest e&o insurance” is essential.

I have discussed in detail about e&o insurance. It will assist you in choosing your preferred insurance company based on your budget. At the same time, you get to know the cheapest e&o insurance.

Mehedi Hasan is an insurance expert with over 6 years of experience in the industry. He has a deep understanding of various types of insurance policies and is skilled at helping clients find the coverage that best fits their needs. In his current role, Mehedi works as a consultant, advising businesses and individuals on the best insurance options for their specific situations.

He is also a frequent speaker at industry events, sharing his knowledge and expertise with colleagues and professionals in the field. Mehedi holds a degree in insurance and risk management and is committed to staying up-to-date on the latest industry trends and developments. In his free time, he enjoys reading, traveling, and spending time with his family.