If you are a tour lover, travel insurance is for you. Just because you have money to buy a ticket doesn’t mean you can bear the cost of your tour. Traveling to another country or province can be expensive without travel insurance. Suddenly you can get sick, and you need lots of money.

How much do you have to pay if you become sick on tour and stay in a hospital for an entire night in the United States? Well, it can cost up to $14,000. You need the insurance plan to pay for emergency medical care if you are away.

Last year, I became sick while traveling to New York City. Eventually, I had to stay in the hospital for two days. I managed to pay the high costs of the hospital bill through goose travel insurance.

Now you can ask me, “Is goose travel insurance good.” How do I deny the service I get from goose insurance? This article briefly discusses goose travel insurance and why you should choose it.

Overview of Goose Insurance

Goose provides travel insurance. It provides coverage based on the number of days you need. It has notifications, alerts, and a locator for emergency services. Goose Insurance was founded in 2017. Goose Insurance Services ensures Canadians have travel insurance that protects their tail feathers.

Goose was founded to bridge the gap between the old-fashioned insurance business and today’s customer aspirations. Goose’s main mission is to keep Canadians safe. Goose is the market leader in travel and health insurance.

Canadians can get insurance worth up to $10 million for just $4 a day. For that, they do not have to go through a tedious application process or pay high premiums or other costs. Goose now serves British Columbia, Alberta, Saskatchewan, Manitoba, and Ontario.

Advantages of goose travel insurance

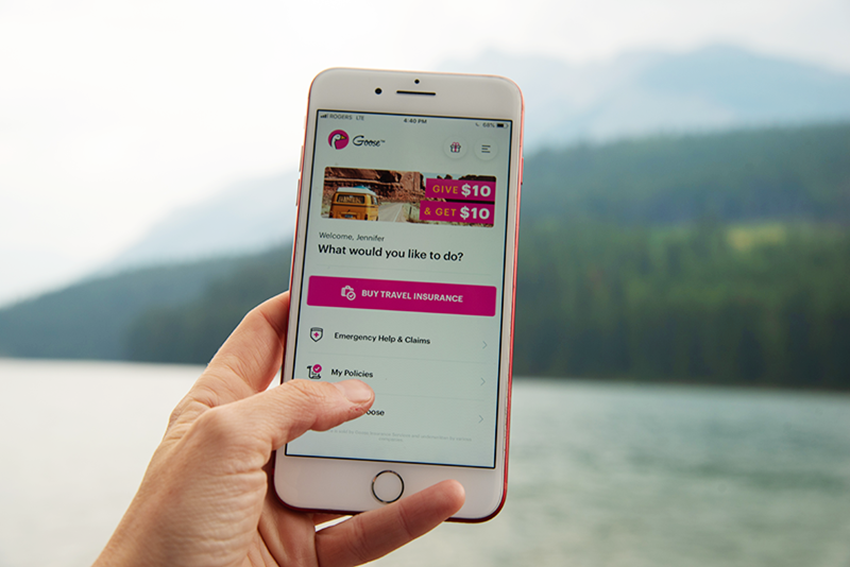

- You can use the Goose app for buying and managing insurance.

- With a single call to their toll-free number, you can get 24/7 customer service.

- You can use the goose website for online applications and queries. It is simple to use.

- Customers can use Goose’s website for live chat with agents.

Disadvantages of goose travel insurance

- You need to download the app or call customer care to know about goose plans.

- There are a lot of sports and outdoor facilities that need to be covered. Some necessary facilities are missing in goose travel insurance.

What is covered by Goose travel insurance?

Goose travel insurance provides different types of cost-effective packages. These include benefits for travel interruption and medical aid in an emergency. The most popular plans with Goose travel insurance are as follows:

- Medical Insurance for a Single Trip

Goose travel insurance’s Single Trip Medical coverage has a maximum limit of $10 million. And it provides comprehensive medical coverage. The plan covers both emergency and regular medical interventions.

There is coverage for emergency dental work. You can get up to $500,000 in the COVID- 19 per trip. Depending on the coverage plan and budget, you can get up to $5,000 of coverage for trip interruption or cancellation.

- Medical Insurance for Multiple Trips

This plan is for people who enjoy traveling. Goose provides help for up to 60 days spent outside the country during the year. The maximum coverage is $10 million, including emergency dental and medical care, prescription drug coverage, and family transportation.

Trip cancellation and interruption insurance up to $5,000 protects against sudden travel plan changes. There is up to $500,000 in COVID-19 coverage per trip.

Goose travel insurance: what makes it unique?

You will get lots of benefits from goose travel insurance. Eventually, you can take a decision about “Is goose travel insurance good.”

- It’s incredibly simple and quick to use: Goose has a smart application. It allows you to buy travel insurance for only 60 seconds or under from your cell phone. It will enable you to purchase travel insurance through the mobile app.

- It is extremely cost-effective: Goose Travel insurance is available at a low cost. You have to pay $4 per day.

- You can buy it even after you return from vacation: Goose Insurance can be bought up to seven days after your holiday has started.

- Cool features: Goose provides cool features for its customers. Those are:

- Hospital locators in every country.

- You can get the Goose app from Google Play or the App Store.

- Within the app, you can access your insurance in an easy-to-read format.

- Geo-targeted reminders: If the app detects that you are near an international airport or the US border, it will send you a reminder. The app has options for instant agent chat.

- Maximum coverage of $10,000,000: Goose provides 24-hour coverage for up to $10 million.

- Program for Referral: Goose has a fantastic referral program! You can receive $10 in credits by signing up. Moreover, by activating Smart Goose notifications, you can set up an alert to remind you to buy travel insurance before you leave for an airport or border.

Travel insurance policies for US residents

- USA Plus Plan

USA Plus Plan is applicable anywhere in the world that is more than 50 miles away from your home. You will get coverage for the followings:

- Medical costs in an emergency

USA Plus Plan covers emergency medical costs up to $250,000. The coverage maximum is $150,000 for New York, Oregon, Montana, and Pennsylvania residents and $20,000 for Missouri and Washington.

Whether you travel in the United States (when you are more than 50 miles from home) or anywhere else, this plan is applicable. Since COVID-19 is treated like other illnesses, this policy can cover travel-related costs up to the limits of your policy.

- Trip Cancellation or Trip Interruption costs

USA Plus Plan provides pre-paid non-refundable travel fees if objects on your itinerary drop before your flight (or are blocked after take-off) due to an unexpected explanation stated in your agreement clause.

The COVID-19 pandemic can directly or indirectly affect some travel cancellation reasons. The specific conditions of each plan can vary, and only some covered causes are included for some projects.

- Sickness.

- Death.

- The quarantine.

- Called to military duty.

- Being obligated to work while on the trip.

- You are being fired or laid off from your job.

- Medical Emergency (Goose International Plan):

Goose International Plan covers medical costs up to a maximum of $5,000,000 while traveling outside the United States. This package is available to travelers aged 70 to 79, but the maximum amount covered drops to $250,000 for them.

This plan is suitable for trips lasting up to 365 days, but coverage can be extended for up to two years. This plan does not now cover trip costs. If you want insurance to cover your trip costs, you must purchase the Trip Protection Plan (USA Plus).

- Annual Multi-trip COVID-19 plan

COVID-19 multi-trip plan annually covers COVID-19-related emergency medical travel costs. You can take 30-day vacations. Throughout the year, coverage extensions are available for longer journeys (up to 180 days). This package is available to travelers under the age of 75.

This plan covers up to $200 per day, up to a maximum of $2,800, for meals and housing while in quarantine. This plan has a maximum cost of $10,000 per family for COVID-related reasons. It covers trip interruption and cancellation up to $2,500 per person per trip! The coverage limit of this package is $500,000.

Availability of Goose Travel Insurance

Goose provides services to Nova Scotia, Alberta, British Columbia, Saskatchewan, Manitoba, Ontario, and Quebec. The business aims to make travel medical insurance easy to use, convenient, and cheap. Customers can buy policies using their smartphones in less than 60 seconds.

Goose can provide instant coverage and intelligent notifications and updates by combining the simplicity of technology with the on-the-go lifestyles of today’s travelers. An in-app locator, 911-like alternatives, and the seamless ability to add coverage or reach an agent from anywhere are just a few of the ways that Goose makes emergency services easier to access.

Why should you consider goose travel insurance?

Goose travel insurance provides amazing support for its customers. A stand-alone global pandemic insurance policy has been made available by Goose Insurance Services in collaboration with Lloyd’s of London and MSH INTERNATIONAL (Canada).

It covers Canadian travelers for emergencies associated with the Covid-19 virus up to CA$500,000. For only $99 a year, Canadians will get access to emergency care when traveling that costs up to $500,000 due to a pandemic.

Dejan Mirkovic, the president of Goose, said Goose Insurance is committed to fulfilling the needs of its customers and making the insurance buying process simple, quick, and convenient for them.

Canadians must have proper coverage because medical bills can be highly expensive in many parts of the world, especially when treating Covid-19. Goose is a pioneer in modernizing and streamlining insurance for Canadians, claims Guillaume Deybach, COO of MSH Americas.

Goose provides travel medical insurance for emergency medical care, which starts at $4 per day. The policy covers coverage for unstable pre-existing medical conditions for all Canadians under 59 who travel for 35 days or fewer. It provides up to $10 million in coverage for evacuation and medical emergencies.

Getting travel insurance and smartphone pandemic guidelines takes less than a minute. The Covid-19 scandal has greatly influenced the Canadian travel insurance market and the way that so-called “snowbirds” travel. Because of this, Canadian airlines now provide Covid-19 coverage, and Goose travel insurance is the most recent Canadian insurer to do so.

Frequently asked questions

Many questions can come to your mind about “Is goose travel insurance good.” In this part, I have included some important questions for your convenience.

How much does a Goose policy cost?

Goose’s travel insurance costs vary based on your age, desired level of coverage, destination, and trip time. You have to look around before choosing Goose travel insurance! You have to compare the other travel insurance benefits.

How do I get a Goose plan?

Goose insurance can be bought by calling 1-888-37-6673 or through the mobile app.

Does Goose travel insurance cover Covid-19?

Goose travel insurance provides a COVID-19 coverage plan with an ambulance and 24/7 emergency response for up to 30 days and unlimited trips. You can directly submit a claim on the Goose travel insurance website. If you want to submit your claim, you can call 1-604-305-0500.

Does Goose provide life insurance?

Goose provides insurance for financial soundness, health, and life insurance. Goose provides protection that takes care of you and your family when you need it most, from managing the funeral costs and managing costs to recovering from a critical illness and paying medical bills.

You can buy life insurance to ensure your loved one’s future. You will be glad to know that this policy will help pay unpaid debts, final costs, or other matters important to your family. Eventually, it gives you peace of mind.

Where are the headquarters of Goose Insurance?

The main office of Goose Insurance is in Vancouver, British Columbia, Canada, at 825 Homer St., Ste. 380.

What is the official Goose Insurance website?

The official Goose Insurance website can be found at www.gooseinsurance.com.

How many employees does Goose Insurance have?

Twenty-five people work for Goose Insurance.

Who are Goose Insurance Services’ investors?

Impression Ventures, Google Cloud Accelerator Canada, and Plug and Play Accelerator are Goose Insurance Services’ investors.

Final Thoughts

With Goose Insurance, you can protect against travel delays and medical emergencies. Goose Insurance ensures that travel plans continue without incident by presenting cost-effective packages.

When you are away from home, travel insurance is a must. It ensures you get financial support and pay for health care. You cannot say a company is bad if you get amazing facilities from an insurance company. Isn’t it?

By this time, you get the answer to your question, “Is goose travel insurance good.” We are on the same page to agree with the statement: Goose travel insurance is good.

Mehedi Hasan is an insurance expert with over 6 years of experience in the industry. He has a deep understanding of various types of insurance policies and is skilled at helping clients find the coverage that best fits their needs. In his current role, Mehedi works as a consultant, advising businesses and individuals on the best insurance options for their specific situations.

He is also a frequent speaker at industry events, sharing his knowledge and expertise with colleagues and professionals in the field. Mehedi holds a degree in insurance and risk management and is committed to staying up-to-date on the latest industry trends and developments. In his free time, he enjoys reading, traveling, and spending time with his family.

Yes, Goose Travel Insurance is generally considered good due to its comprehensive coverage options and positive customer reviews. However, it’s always wise to compare policies and read reviews to ensure it meets your specific needs.