My friend David went through a lot of hassle in the first phase of his marketing business. The first obstacle he faced during the start period was not enough capital, to begin with.

It is that time he came to know about the corporation- Kabbage. It is a well-trusted company that provides loans to amateur businessmen. Their payment process is also very flexible, with installment options to feel more comfortable.

Kabbage also includes business checking accounts that allow you to deposit profit from your business and offers additional interest. Such an amount of money should also have an insurance policy for protection, and what better company is there other than FDIC?

Therefore, is Kabbage FDIC insured? This article will reveal the secret of Kabbage’s insurance policy and provide more detailed information about their checking accounts.

Kabbage- And Their Business Checking Accounts

In simpler terms, you can call Kabbage a bank for small loans for starting a small-scale business. This particular institution started its business on May 2011, and since then, its member recruitment has been top-notch.

Kabbage has a loan range from 2000 dollars to 250,000 dollars depending on the infrastructure of your business. Obviously, your need to file all the official papers of the validity of your business to achieve their trust.

Apart from that, the payment system is very user-friendly Kabbage. They offer you a significant period within which you can go for the full repayment. Additionally, there are also 3 installment repayment options to choose from, such as 6, 12, or 18 months intervals.

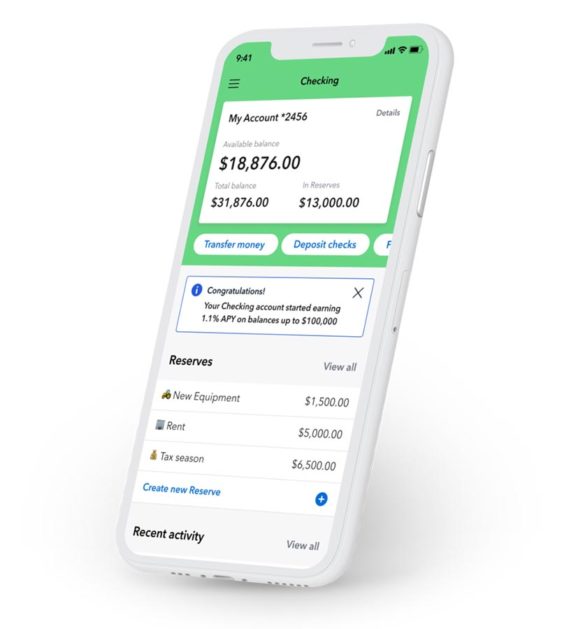

In recent times, Kabbage gave a new option to their clients- a chance to open a business checking account under their supervision. What is a business checking account? It is an online transaction platform where you can deposit or withdraw money at the time of your need.

Moreover, you can set up an advanced payment system for your daily needs, as this particular business account offers both credit and debit card payment systems.

Kabbage’s customer care service is ready for you 24/7. Other features are included in your Kabbage business checkings, such as Kabbage Funding, Kabbage insights, and Kabbage Payments. Moreover, the employees at Kabbage are very skilled and experienced. They will clear your every confusion about their services on both online and offline platforms.

Such profitable accounts in Kabbage should have some insurance policy in case catastrophic events such as bank robbery, power outage, or transaction failure arise. Hence, this is where FDIC insurance policies shine.

Is Kabbage FDIC insured? Let’s find out!

More About: Is Merrill Edge Fdic Insured?

Kabbage- Validity Of FDIC Insurance

Kabbage Loan Institution is not a bank, which is why it goes under the supervision of Green Dot Bank. This particular bank is a member of FDIC (Federal Deposit Insurance Corporation), which is an independent insurance company that covers and maintains financial balance for millions of consumers owning a bank account.

FDIC covers nearly all commercial banks around the United States, but this corporation provides certain limitations. To participate in FDIC insurance coverages, the bank’s accounts should be depository, such as checking, savings, transactional, etc.

As per the rules and regulations of FDIC, you can see that Kabbage will be the most suitable under their insurance policies. So, is Kabbage FDIC insured? Yes, definitely!

All the categories of Kabbage checking accounts mentioned above fall under FDIC insurance. If there is anything wrong with your payment status, or someone performed a huge money withdrawal from your checking account in your absence, FDIC insurance will take care of it.

The coverage money rises up to 250,000 dollars which you will receive after carefully investigating your transactional disaster. You must provide details of your checking account, bank statement, and other necessary information.

The insurance experts at FDIC will take a few days to ready your papers. Eventually, the insured deposit money is transferred to the client within two working days, and other late cases are considered exceptional cases.

Kabbage- How to Apply for The Checking Account

The process of applying for the Kabbage checking account is quite simple. All you need to do is to visit their official website page and fill out the necessary information.

Once you have visited the website, you will notice an option as “Apply,” where you need to click, and another window will pop up. In that window, you need to provide information about the business, such as starting year, type of business, industry name, contact information, and many more.

After providing the above information, you have successfully opened a checking account with Kabbage. Now you need to give some necessary scans of documents for the verification process.

The necessary documents will include your photo, passport ID (if any), personal contact information, etc. Once you have submitted the scan copies, the verification process will be complete.

Kabbage- How to Apply for The Business Loan?

In order to apply for the Kabbage business loan, there are some criteria that you need to fill out. The requirements are as follows:

- The owner must be at least 18 years old.

- Your business firm should stay operational for at least 12 months or more. To verify this, Kabbage will ask for your last year’s bank statement of your business.

- You need to enroll in an efficient business checking account, and it certainly does not have to be Kabbage.

- You need to have a satisfactory application submitted to them and also mention the amount of loan that you desire.

Once the employees of Kabbage have run a full diagnostic of your papers, the verification process will be complete, and they will send you a notification. After that, you will receive your stated loan amount in your business checking account within the next 2 working days.

Kabbage- Money Withdrawal and Deposit

You would be pleased to know that Kabbage does not charge you additional costs while withdrawing money from your business checking account. Furthermore, customers can withdraw a maximum of 2000 dollars from their account per day.

As we have already mentioned, Kabbage is available all over the 50 United States, so money withdrawal is possible across 19000 ATMs nationwide.

As for the payment system, the Kabbage company will send you a debit card within 5 – 6 working days after you have enrolled in a business checking account. Furthermore, if you use a Kabbage checking account in your business, it allows credit card payment which will be very efficient in terms of handling payments from your clients.

Kabbage- Pros and Cons

Up to this point, Kabbage has been friendly to us with all the fantastic features of depositing money online and offline, options to lend money, and checking accounts.

But all good things have some drawbacks that one wise client should consider. Therefore, here goes the listed pros and cons of being a Kabbage customer:

Advantages

Provides Integration with other Kabbage Account Services: If you own a Kabbage business checking account, you will have direct access to additional funding, payments, and other insights provided by their server.

No Withdrawal Costs: Many other business corporations will charge you a huge percentage on every withdrawal. But, in the case of Kabbage, it offers you zero withdrawal costs. As the money withdrawal rate is very often for some businessmen, it is highly advantageous for them.

Broad Business Networks: Kabbage has an extensive business network around the United States, making it easy for you and your clients to make transactions without hassle.

Provides 10% APY Rate: Yes! With a Kabbage business checking account, you can earn a significant amount of money after you have made a deposit. For example, you just enrolled 10000 dollars on your checking account.

The Annual Percentage Yield (APY) is a 10% increment which will increase your deposit amount to 10000 dollars at the end of the year. Therefore, with more deposition comes more increased amount annually.

Disadvantages

Includes Significant Deposit Fees: Though Kabbage does not have any withdrawal costs, as a source of income for the corporation, it will charge you 4.95 dollars on each deposit of your money.

Our research shows that some similar corporations do not charge any deposit fees, and if they do, the charge is relatively less than Kabbage’s.

No Third-Party Involvements: Kabbage does not allow any third-party under-friendly accounting software, which will make it easy for the clients to keep their bank statements and many more.

Beginner Level: Though Kabbage attracts many checking account users’ attention, it is still new to the marketing world. Therefore, there might be some flaws in their business plans. Some people claim that their website is not that developed.

Therefore, we are saying there is still room for development, and we will suggest giving a second thought while enrolling for their services.

No Joint Accounts: Kabbage does not involve joint accounts in its system. This stops multiple users from sharing one account, which accounts for simplicity. As we said, their business plan is still under supervision.

Frequently Asked Questions

What is the minimum time required to deposit money in the Kabbage checking account?

After you have made the deposit, it straightly goes to the employees of the Kabbage. After carefully verifying the transaction, the manager issues the money to your account. Afterward, the online servers receive a command to update your account’s capital. This whole process does not take more than 2 – 3 working days.

Can we get FDIC insurance coverage after enrolling with Kabbage?

Yes! FDIC provides insurance coverage to almost all commercial banks across the United States. The insurance coverage has a maximum limit of 250000 dollars which you will receive within 2 – 3 days after careful evaluation.

What is meant by deposit insurance?

Deposit insurance is a type of insurance that is only provided to depository bank accounts. It is usually offered to the customers if there is any transaction error on the accounts. Every FDIC-insured bank receives a maximum of 250000 dollars of deposit insurance to ensure there is no hassle with customer service.

Can I get more than 250000 insurance money from an FDIC-insured bank?

Though this case is rare, the maximum deposit insurance limit is 250000 dollars. But in case of emergency, FDIC provides an extension in their limited insurance money, thus exceeding the stated value.

Can we consider Kabbage as FDIC insured bank?

First of all, Kabbage is not a bank! Kabbage is being supervised under a bank named Green Dot, and that particular bank has FDIC insurance coverage plans. FDIC is ready to provide 250000 of insurance money to every deposit bank account in Kabbage under Green Dot Bank.

What is the minimum credit score to get a good loan from Kabbage?

The minimum credit score required to establish a loan from Kabbage is 640. Other than that, it would help if you showed that your business has been running for at least a year and has monthly revenue of at least 3000 dollars.

Is it hard to get approval from Kabbage?

No application process is complex unless you think so. To apply for a Kabbage loan, you must fill out some basic information about yourself and your business. Then after the verification process, the stated loan will be in your business checking account within 2 – 3 working days.

What will happen to the loan if the current business eventually fails?

That is a policy that the Kabbage business corporation maintains. If your current business fails after taking the suitable loan, you still need to repay the loan within the stated period. Otherwise, the corporation will take legal action against you.

Conclusion

So, to wrap up, you can see Kabbage has many advantages which one should take into action while using their services. But they are still a growing company, and their business experience is short. So, please think twice before enrolling on a business checking journey with them.

On top of that, is Kabbage FDIC insured? Yes! The availability of a Kabbage checking account is widespread around the United States. So, you will have no worries thinking about the security of your deposited money.

Therefore, the next time someone asks you about Kabbage’s FDIC insurance policy, enlighten them by suggesting our article.

Have a good day!

Mehedi Hasan is an insurance expert with over 6 years of experience in the industry. He has a deep understanding of various types of insurance policies and is skilled at helping clients find the coverage that best fits their needs. In his current role, Mehedi works as a consultant, advising businesses and individuals on the best insurance options for their specific situations.

He is also a frequent speaker at industry events, sharing his knowledge and expertise with colleagues and professionals in the field. Mehedi holds a degree in insurance and risk management and is committed to staying up-to-date on the latest industry trends and developments. In his free time, he enjoys reading, traveling, and spending time with his family.